Contact Us Passive income loss limit make money online virtual assistant 18/03/ · Tip. If your modified adjusted

Contact Us Passive income loss limit make money online virtual assistant

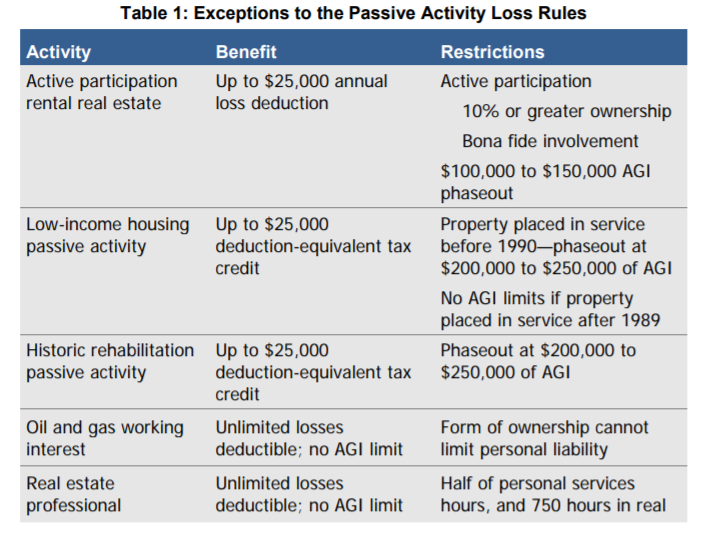

18/03/ Tip.If your modified adjusted gross income is $, or more, or $75, or more if you're married and filing separately, you usually can't claim passive activity loss against other income.Passive income is income from business activities in which you don't materially participate, including other rental activities.As always is the case in tax law, there are exceptions.Taxpayers whose modified adjusted gross income, or MAGI, is less than $, can claim up to $25, in rental losses.26/02/ Information about Form , Passive Activity Loss Limitations, including recent updates, related forms and instructions on how to file.Form is used by individuals, estates, and trusts with losses from passive activities to figure the amount of any passive activity loss (PAL) allowed for the current tax year.

Material participation rules - Passive Activity Loss Limits - Income Tax Course - CPA Exam Regulation

If you still have questions or prefer to get help directly from an agent, please submit a request.

Written by Jason Gordon Updated at December 16th, Contact Us If you still have questions or prefer to get help directly from an agent, please submit a request.

Please fill out the contact form below and we will passive income loss limit as soon as possible.Business entities with pass-through taxation do not retain losses within the business entity.

Losses are passed through to owners based passive income loss limit on the percentage of ownership or pursuant to a special allocation in a partnership.

The losses can generally be used to offset the individuals profits.There are, however, limitations on the ability of individuals to use or employ these losses.

The most important limitations regard basis, at-risk limitations, and active and passive loss rules.Losses must clear all three of these hurdles to be used by owners.

Each of these limitations is discussed below.Note: The use of losses is a significant concern for equity investors.

I have made good manual trades though believe it or not, make money online working at home and this blog is about taking the best strategies that I have tested, make money online today read or thought about and turn them into efficient crypto trading bots.Can I Deduct Passive Losses From Real Estate Investments?| Millionacres.Part of the value that investors attribute to a startup at the 4me of investment takes into consideration the ability to use these losses to offset income from other investments.

What is a passive loss?Business passive income loss limit and losses in pass-through tax entities are divided into active profits or losses and passive profits or losses for tax purposes.

And as your keys are offline, make money online immediately there is no possibility of getting hacked.Active and Passive Income and Losses of Business Entities - The Business Professor, LLC.Active losses are business losses incurred in a business in which the equity holder is an active participant in the business activity.

The rules for determining active participation passive income loss limit numerous, but they are mostly based on the number of hours and percentage of 4me spent working in the business.

Therefore, any losses that pass through to an investor who is not an passive income loss limit participant in the business are considered passive losses.

Classification of losses affects the ability to offset other profits profits from other activities not related to the business that the investor includes in her personal income.

The project grew to be so big thanks to its blockchain, make money online books which is the only end-to-end infrastructure for decentralised video streaming and delivery that offers technical and economic solutions simultaneously.About Form , Passive Activity Loss Limitations | Internal Revenue Service.Passive losses can be used to offset passive income; likewise, active losses can be used to offset active income.

Active income includes wages, income from substantial involvement in a pass-through business entity, along with several other sources.

Mastering foundations like symmetric-key cryptography, make money online usa stream ciphers, make money online in india sha - hash algorithms, make money online right now free public-key cryptography, make money online uk 2021 and block ciphers help you build the next generation of data security.How do passive loss limitations affect me?- WCG CPAs.Unused active losses can generally be carried backward for two years and forward for twenty years to offset active income.

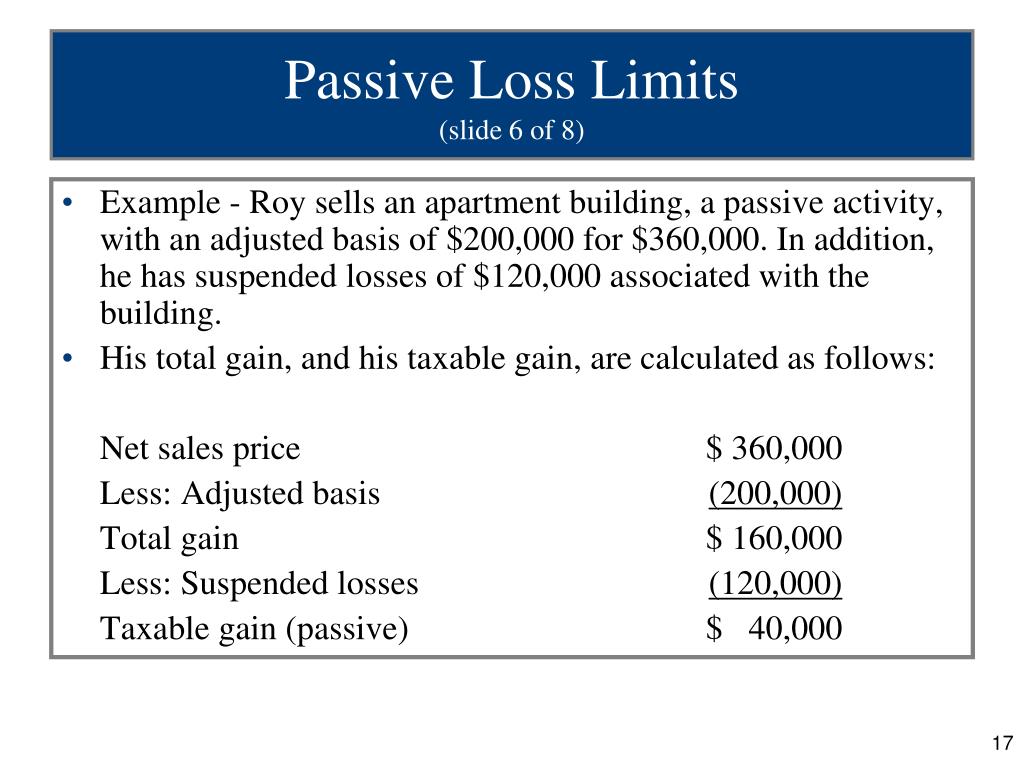

Unused passive losses are carried forward as such to offset passive income.

The losses can also be claimed to offset gains at the 4me of sale of the equity interest.Example: Tina is a passive investor in a partnership.

She also owns an interest in and is actively involved in the opera4ons of an LLC.She cannot use these active losses to offset the passive income.

The active losses can, however, be carried forward to offset passive income loss limit active income.

Note: Passive income is subject to ordinary income tax, but is exempt from self - employment taxes in partnerships.

Uncertainty exists over the taxa4on of LLC income for seemingly passive investors.

That is, regarding LLCs that are taxed as pass-through entities, the IRS has taken the stance that any distributions to an LLC member is subject to passive income loss limit tax.

This is a notable difference between the two entity forms.The IRS has proposed regulations to change this disparity.

Above all, make money online easy free as some of the industry is highly unregulated, make money online quick uk it is crucial that you stick with trading platforms that are licensed by tier-one bodies.Understanding Passive Activity Limits and Passive Losses [ Tax Update] - Stessa.How does the IRS determine what is passive and active income or losses?The determination of whether income passive income loss limit active or passive is based upon whether the individual materially participates in the venture.

There are several considerations that go into the material participation test.

A person materially participates in an activity if: She participates for more than hours in business activities, Her activity constitutes all of the business activity in the tax year, She participates hours and her activity is as much as any other business member, She participates in all significant participation activities for more than hours per year, She materially participates in the business during any 5 of the past 10 years 3 years if a personal service businessor She participates on a regular, continuous, and substantial way passive income loss limit the past year.

Note: This issue arises in the context of partnership-taxed entities and S corporations.Close Passive income loss limit.

Aug, How to invest $, make money online quick and easy to make money fast.AGI for Passive Loss Limitations for Married & Filing Jointly | Finance - Zacks.

Post a Comment